Predictable payments,

anywhere they need to land

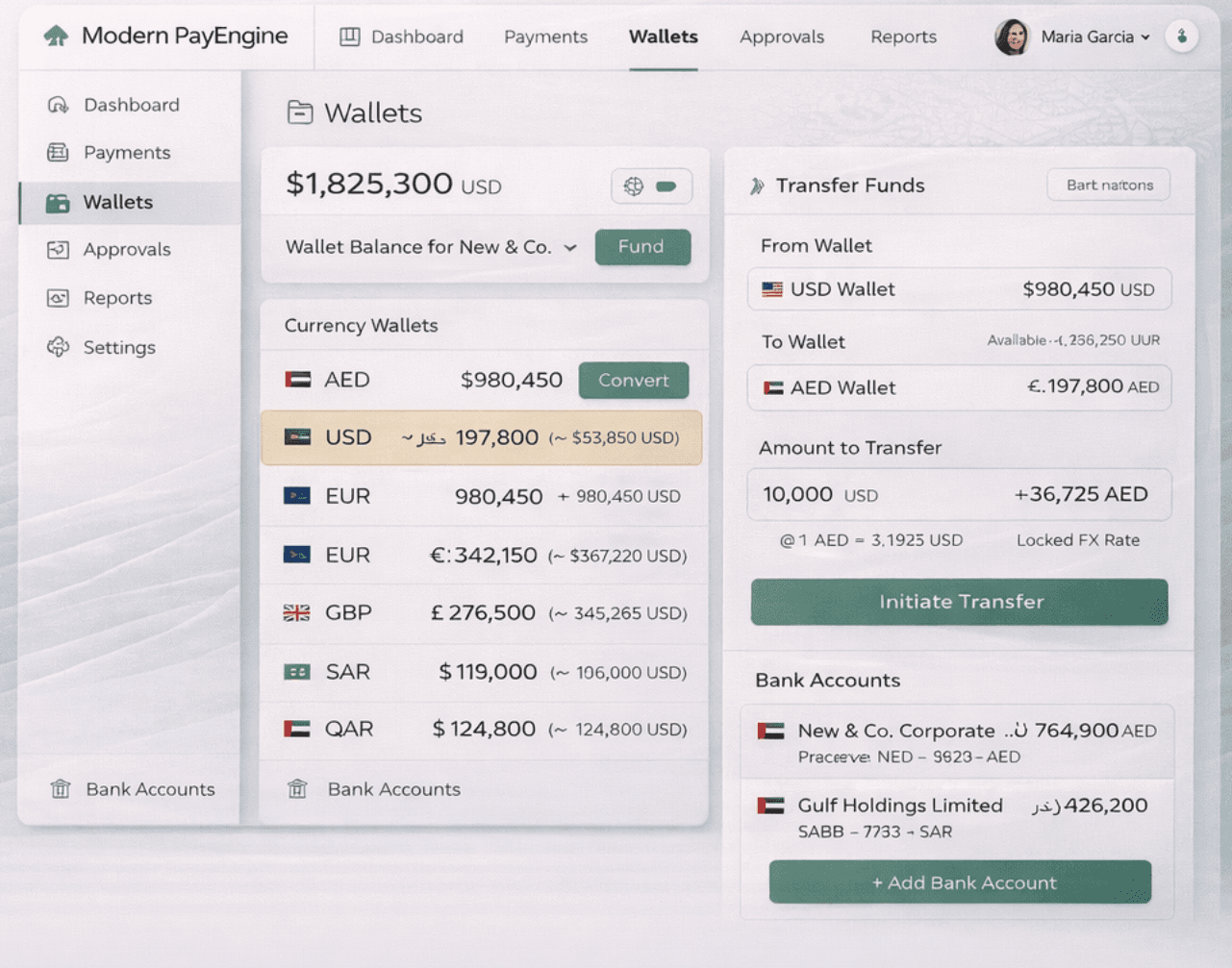

Modern PayEngine is the financial control plane that governs how value moves— so enterprises get predictable outcomes even as execution paths, rails, and connectivity change.

Define policy, approvals, funding, and FX once. Then execute through regulated domestic banks, licensed global partners, or hybrid and satellite-enabled connectivity—without redesigning workflows or replacing existing systems.

Control without rigidity

Modern PayEngine separates control from execution. Governance stays constant while settlement adapts to geography, regulation, and connectivity—eliminating manual exceptions and surprises.

Execution that adapts

Payments execute through the most appropriate regulated path—local banks for domestic settlement, licensed partners for cross-border flows—without changing approval logic or reporting.

FX and funding with certainty

FX and funding decisions are governed before release, so delivered amounts and timing are known upfront—not discovered after settlement.

Resilience beyond terrestrial limits

Satellite and hybrid connectivity allow financial control to persist even when ground infrastructure degrades—supporting critical operations, remote environments, and future autonomous systems.